In regulated industries, 80% of the technology stack is non-differentiating. By collaborating on this shared infrastructure through FINOS, institutions mutualize development costs to build safer, compliant, and interoperable systems faster.

These projects are immune to vendor "rug pulls" or restrictive license changes because they are protected by The Linux Foundation. You get fully production-proven solutions actively used by major global banks—with no "Enterprise Edition" paywalls, no hidden costs, and no lock-ins.

View Session Recordings Here or View Selected Resources

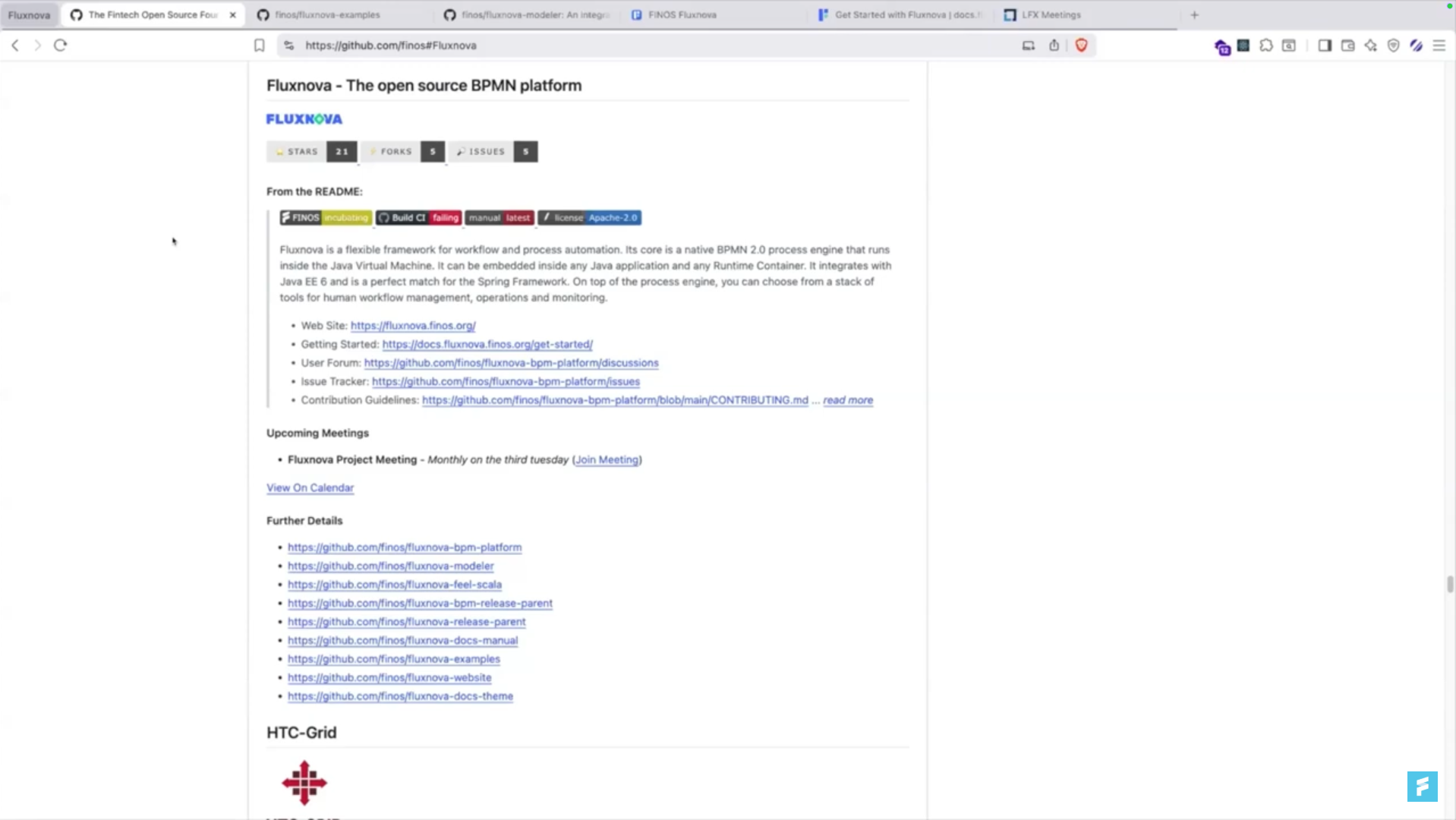

Access the production-ready open source standards, compute engines, and governance frameworks powering the world’s leading financial institutions.